Day trading, an intriguing world of rapid financial decisions and potential returns, captivates a multitude of individuals seeking to navigate its intricacies. Whether it be the vibrant stock market or the round-the-clock Forex market, each arena presents unique opportunities a trader might leverage for success. This elucidation delves into the nurturing fundamentals of day trading, providing a meticulous analysis of its chief constituents: stock market day trading and forex day trading. The intention is to equip the reader with a robust understanding of both segments, thus facilitating informed decision-making in these volatile markets.

Understanding Day Trading Basics

Day trading, the rapid buying and selling of stocks within a single trading day, offers both tremendous rewards and profound risks. For savvy entrepreneurs who understand the dynamics of this high-paced, high-stakes business world, the possible returns can be exhilarating. However, it’s not a route to financial success for everyone. If you’re considering venturing into day trading, you need to understand the fundamental principles and potential risks.

The Day Trader’s Mantra: Buy Low, Sell High

The core principle of day trading is the classic mantra: “buy low, sell high“. Day traders leverage minor, short-term discrepancies in stock prices, purchasing stocks when they’re priced low and selling them off as soon as their value increases. In theory, this practice enables traders to earn profits within a single trading day, hence the term “day trading”.

Innovation and Flexibility: Keys to Smart Trading

As an entrepreneur, you know innovation is the heart of any successful venture. Day trading is no different. It’s not just about staying abreast of the latest industry trends, but also about paying attention to the global socio-political climate, technology, and market sentiment. Mastering these factors requires considerable market knowledge, investment proficiency, and a keen sense for timing.

Risk Management: Balancing Potential Rewards against Potential Pitfalls

For all its potential rewards, day trading can also pack a punch in the risk department. Day traders often use leverage (money borrowed from a brokerage) to invest in trades. This can potentially magnify gains. However, it can also multiply losses. Market volatility can wreak havoc with investments, and even experienced traders can fall victim to the rapid shifts in share values. Therefore, risk management is critical.

Additionally, ‘short selling’, a trading technique used to profit from falling stock prices, can present massive potential losses if the value of the stock increases instead of falling as anticipated.

The Slavery to Emotional Rollercoasters

Day trading is not for the faint-hearted. It demands a tremendous amount of discipline, constant monitoring of quickly shifting markets, and decision-making under pressure. It requires the mental fortitude to avoid the human tendency to overreact to profits or losses. Emotion-fueled decisions in day trading can lead to costly errors and generate immense stress.

In conclusion, day trading is not a straightforward endeavour and is only recommended for those who fully comprehend the associated risks. As in all business ventures, knowledge, preparedness, and the ability to pivot, are the keys to achieving success in this high-risk, high-reward arena. Arm yourself with the right mental armoury and financial acuity, and only then consider stepping onto the day trading battlefield. Remember, it’s all about staying rational amidst the chaos, keeping risks in check, and never losing sight of the ultimate goal – profit.

Dissecting Stock Market Day Trading

Understanding the intricacies of day trading in the stock market is no mean feat. It requires a unique set of skills and characteristics. Beyond the understanding of concepts like innovation, flexibility, risk management, and leverage, there are overarching considerations like regulatory dynamics and technology influences, which are unique to this form of trading. Moreover, the challenges associated with emotions and stress, the necessity for knowledge and preparedness, and the emphasis on achieving profitability signal the complex nature of day trading.

One key element of day trading is its regulatory dynamics. Day traders operate within a robust regulatory architecture created to maintain market integrity and protect investors. These rules dictate the minimum equity traders must maintain in their accounts and the maximum number of trades they can execute within a defined period. While these stipulations can seem restrictive, they also act as safeguards against potential losses and uncontrolled trading.

The rapidly evolving technology landscape also uniquely marks day trading. Technological capabilities such as algorithmic trades and high-frequency trading tools can significantly boost a day trader’s capabilities. AI and machine learning also make it possible to predict market trends with better accuracy. However, while these advancements offer substantial opportunities, they also pose new challenges. The rapid pace of technological change necessitates constant learning and updating of skills, not to mention the increased cybersecurity risks involved.

Unlike longer-term investment strategies, day trading demands an acute sense of timing and pace. Here, even slight delays can mean losing out on potentially profitable trades. This CALLS for continual monitoring of markets and the ability to make quick, calculated decisions. This ability to operate effectively under pressure and think on one’s feet reinforces the adage that day trading isn’t for the faint-hearted.

Moreover, the socio-economic environment plays a pivotal role in day trading. Everything from political events, economic data releases, to company earnings announcements and market sentiment can sway market movements, requiring day traders to remain well informed and readily responsive.

Lastly, day trading requires a particularly proactive approach to learning. Self-education via books, online courses, seminars, and webinars is paramount, complementing the practical experience gained from actual trading. The internet is abuzz with resources, including trading simulation platforms, which allow potential day traders to hone their skills sans risk.

In conclusion, day trading presents a field laced with unique characteristics and challenges. It’s a rigorous landscape, requiring astute regulatory understanding, technological adaptiveness, swift decision-making, socio-economic sensitivity, and a commitment to continual learning. Those willing to navigate this complex yet rewarding journey will discover that the world of day trading is as invigorating as it is demanding, bearing the potential to unlock unprecedented financial rewards.

A Deep-Dive into Forex Day Trading

Stepping into the thrilling world of Forex Day trading immediately establishes a distinction from other trading spaces. It’s a global powerhouse, firing on all cylinders, 24 hours a day, five days a week. Both the unparalleled liquidity and market volume ensure there are always opportunities to seize, making it a hotspot for savvy entrepreneurs.

One of the core attributes setting Forex day trading apart is its international character. Traders have the privilege to tap directly into the world’s largest financial market, with daily trading volumes pushing past $6.6 trillion. No other trading arena comes close. This vastness also provides a fabulous advantage: diversity. Traders can choose from a smorgasbord of currencies, each knotted to a diverse array of social, political, and economic factors. It’s a buffet for those who like to spice up their portfolio with a dash of exotic risk.

The boundless opportunities demand a trader to be adept at deciphering economic and political events globally. By keeping a pulse on global happenings, one can effectively anticipate market fluctuations, therein capitalising on profitable deviations. What else can be more fascinating than turning global news into increasing capital?

Forex day trading’s omnipresent nature means it’s susceptible to the shifts and currents of a continuously active market. While other trading platforms sleep, Forex is alive and kicking, responsive to developments in Tokyo, London, New York, or Sydney. This 24-hour access offers unique opportunities but also necessitates vigilance, astute strategy, and adaptability.

A unique feature to Forex trading lies in its adaptability to both macro and micro trading. Depending on one’s trading strategy, one might operate on a long-term perspective, analysing countries’ economic health, geopolitical climate and policy changes. In contrast, others might prefer rapid-fire trades, seeking profits from minute changes in exchange rates. Thus, Forex day trading accommodates a plethora of trading styles and methodologies, making it a versatile platform.

Putting disparities in timing aside, the introduction and evolution of technology have guided Forex towards a dynamic digital environment. It catalyses access to real-time information, bolstering decision-making processes and allowing for speedy responses to market movements. Pair these advancements with high-speed algorithms and one obtains a trading field amply suited to the swift, data-focused modern trader.

Yet with considerable potential reward comes responsibility. Forex day trading requires a thorough understanding of financial markets, not just knowledge but a discernible skill in applying it. It demands arduous effort in learning and mastering tools, terms, charts, indicators; essentially, the language of trading. However, the market rewards the diligent who are willing to invest time and energy into honing their skills.

Forex markets are complex, fast-paced, and exist in a state of perpetual motion. It takes a trader of equal gusto and endurance to master its rhythm and ride the waves of opportunity it presents. Yet for the entrepreneurial spirit with the heart for the thrill and the knack for taking calculated risks, Forex Day trading is an unrivalled playground.

Comparative Analysis of Day Trading: Stocks Vs Forex

Day trading stocks presents a unique set of advantages and disadvantages. On the upside, the stock market is global and supports transactions during all hours of the day. It also offers diverse stock options that range from blue-chip to penny stocks. Stocks can be short sold at any time of the trading day, theoretically allowing one to profit from falling prices. Additionally, the deep liquidity of certain stocks facilitates fast and easy trade execution.

On the drawback side, stocks tend to have less leverage than Forex, often capped at 2:1 ratio due to regulations. Moreover, the stock market is heavily monitored and restricted by regulatory bodies which can limit the freedom of traders.

Transitioning to Forex, it notably offers unparalleled access to a high liquidity market 24 hours a day, five days a week. Furthermore, Forex trading demonstrates a relative simplicity due to a limited number of key pairs that most traders focus on. This characteristic of Forex ensures a streamlined decision-making process.

Additionally, Forex supports a high leverage ratio of up to 50:1 which can significantly amplify potential profits (and, correspondingly, potential losses). This, paired with the minimal or non-existent commission fees, makes Forex a popular choice for many day traders.

However, Forex is not without its downsides. The high volatility of the Forex market brings with it pronounced risk. Rapid market fluctuations can result in losses surpassing the initial investment. Also, the lack of stringent regulations can make the Forex market a breeding ground for fraudulent activities.

Finally, let’s not overlook the necessity of staying informed in both types of day trading. In stock trading, this includes keeping an eye on company health, earnings reports, and industry news. Meanwhile, for Forex, an understanding of macroeconomics, global politics, and central bank policies becomes imperative.

In conclusion, both day trading stocks and Forex offer unique opportunities, each with its rewards and risks. It is crucial for any trader to conduct extensive research, develop a thoughtful strategy, maintain discipline, and continuously refine techniques to find success, irrespective of whether they choose to trade in stocks or Forex.

Whether one chooses to day trade stocks or Forex, the ultimate factor dictating success will be an individual’s trading strategy, discipline, emotional control, and persistence. One is not inherently better than the other—it primarily depends on a trader’s risk tolerance, market knowledge, and trading strategy.

Strategic Recommendations for Day Trading

Day trading has forever been a realm of countless opportunities, unparalleled rewards, and significant risks. Certainly, the thrill lies in mastering the art of playing your strategies right, tapping into the pulse of the fast-paced financial markets. Regardless of the domain—be it stocks or Forex—traders are urged to arm themselves with financial prowess, strategic planning, and an unyielding resolve.

When delving into the world of stock day trading, it’s essential to study the trends, the movements of various companies, and understand the long-term potential of the stocks being traded. The big primes of day trading—stock volatility, high liquidity, and trading volume—offer traders the chance to snatch up profitable trades. Yet, the challenge lies in the vast competition with top financial institutions for company shares. Moreover, maintaining constant vigilance over market hours and capitalising on small price movements can often seem daunting.

Comparatively, Forex day trading presents an entirely unique landscape. The colossal and diverse nature of the Forex market offers a playground with an array of currencies to pick from and a market that operates around the clock. Acting on global economic data, political events, and interest rate changes, Forex traders need to perfect the art of timing their trades. Despite the potential for high profits, the swift nature of Forex markets constitutes a high degree of leverage, amplifying both gains and losses just as quickly, proving to be a double-edged sword.

Information forms the backbone of success in day trading. Whether dealing with stocks or Forex, staying updated with market news, economic announcements, global incidents, political upheavals, even weather changes can impact trading outcomes. Knowledge is power, and staying one step ahead is the mantra for day trading success.

Drawing a conclusion on the realm of day trading, one might say it’s a thrilling game of opportunities and risks. Every market, be it stocks or Forex, comes with its unique set of challenges. However, regardless of the market platform, the keys to success remain universally grounded in financial knowledge, real-time awareness, strategic planning, and above all, the endurance to continuously learn and adapt.

Remember, in the realm of day trading, there’s no room for complacency. Developing effective strategies, alongside in-depth market understanding, is the magic formula that separates successful day traders from the rest. The volatile stocks or the dynamic Forex – each has their flavour of challenges and rewards. Plot your graph with data, adorn it with strategy, trim it with patience, and garnish it with finance acumen, laying out a master plan towards your day trading success.

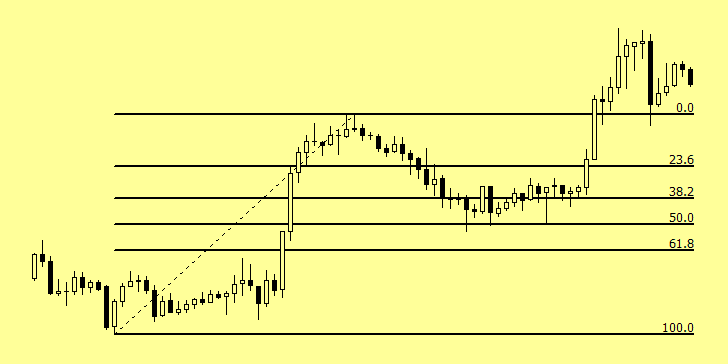

After navigating through the multi-faceted world of day trading, drawing parallels between stock and Forex markets, we note each arena’s unique allure and diverse challenges. The knowledge gained facilitates a deeper comprehension of the intricate dynamics dictating these realms. Furthermore, with strategic recommendations, the reader is empowered to devise definitive trading strategies sculpted by insights into technical analysis, chart patterns, and trading plans. Day trading, although daunting, can unfurl its rewards to those committed to unearthing its complexities and persistently perfecting their strategies.