As many have said about Forex trading, it isn’t rocket science, but it isn’t easy. There are so many moving parts to learning to trade the Forex market. And even beyond the basic skills every trader needs to learn, each trader will have their own preferences and nuances in how and why they make the trades they do. But for someone learning to day trade, any time they can pick up tips or pieces of advice that help them qualify good trades then it is worth the time to learn it.

Learning about correlating currency pairs is one of those little tips. It is not a system or trading method by itself, but it is the understanding that as one particular currency moves, then another pair will likely move in the same or opposite way. By definition, correlation means two things share a mutual relationship with one another. In Forex trading, that means that currency pairs which correlate with each other will move together in the same direction, or will move in the opposite direction from one another, with regularity and consistency.

For example, there is a saying in trading that ‘as the pound goes, the euro will follow.’ What this indicates is that there is some sort of relationship between the euro and the pound – that when one makes a move, the other will move in the same or similar way. It may also mean that the relationship between the pair is one of mutual opposition, and they will move opposite to each other. Much like how a set of magnets will either attract or repel each other, this is the idea of correlating currency pairs.

Understanding Correlating Forex Pairs

There are actually a number of correlating Forex pairs that move together, or in opposition to one another. This is helpful when confirming trades, and looking for indications of how a particular pair is about to move. If the EUR/USD moves the opposite of the USD/CHF, then when there is a buy signal on the EUR/USD, then there should also be a sell signal on the USD/CHF.

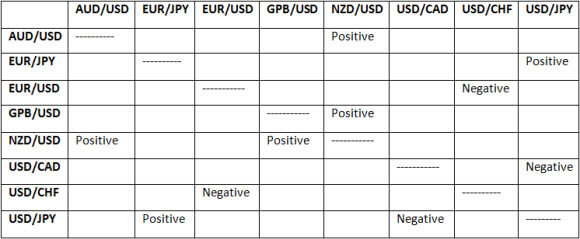

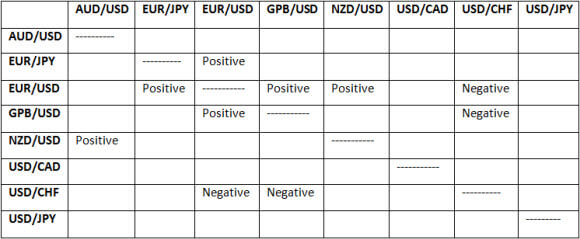

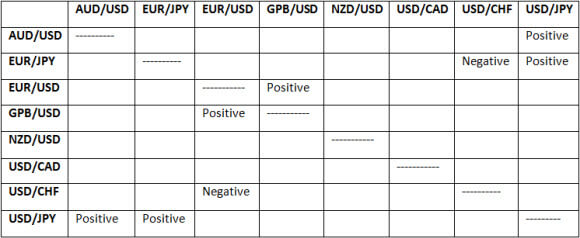

There will be some differences based on the time frames being traded, so make sure you pay attention, especially if you tend to switch back and forth to multiple time frames. The charts below show some of the relationships between various pairs:

5 MINUTE CHARTS

(Positive means the pairs’ movements are closely linked. Negative means they move in an opposite direction)

HOURLY CHARTS

DAILY CHARTS

Be aware that this is like many things in the Forex market; it is a common probability, but never 100% sure thing. There will be times when the EUR/USD moves one way and the GPB/USD moves another. Typically this is due to more isolated news or special events, and they will eventually come back into synchronization. But sometimes you may never completely know the reason.

Usually, you will notice that most of the correlating Forex pairs share some geographical and economical closeness and similarities. This is much of the reason for the correlation. Knowing these relationships can help you make a final decision when looking at a trade, but they will not, and should not replace a solid trading plan. When you have a set up that you are 70% sure of, then use this knowledge to help confirm your trade.

An additional note on correlating trading relationships is that of the Forex market and the commodities market. There are three Forex pairs that correlate nicely with certain commodities. The AUD/USD and NZD/USD correlate positively with the movements of gold. If gold goes up, then so will the NZD/USD and the AUD/USD pairs, because the USD would be weakening. The USD/CAD is connected to oil prices. So if oil moves in a particular direction, then the CAD should follow the same direction.

These little tips can help you along your road to becoming successful as a Forex trader. If you take the time to get to know the pair you are trading and are aware of its nuances and correlations, then you will have a better chance at being successful with your Forex trading. But remember, correlating Forex pairs should only be used as confirmation to a profitable trading system, and should never be substituted for a trading system in and of itself.

Do you see much correlation between EUR/USD and AUD/USD? I see them both as barometers of “risk on” appetite. However I think EUR might be leading AUD at the moment in bullish breakout patterns. If the pattern I’m watching on EU takes off and AU follows and breaks above 1.06 there could be some very nice pips to be had. I made a full video analysis of EUR/USD on youtube here if you want to see the pattern (reverse H&S) I’m watching – [removed]

I totally see a correlation between the AUD and the EUR. And yes, I think the EUR tends to lead the AUD. Gold is also a leader for the AUD, but if you watch the EUR/USD charts you will similar trading. But… the AUD is a little more erratic in some of its reactive moves where as the EUR tends to be a little more conservative and controlled. It’s a little safer to trade.

Thanks for the video link., I will check it out.

Um, I don’t think this is a good idea. I’ve been trading since 2001 and the first chat room I ever joined was constantly telling us to use the “same movement” or correlations between the GBP and EUR. This was a horrible idea. I think that the best approach is to treat each currency solely on its economic factors and conditions and to watch sentiment for that particular pair, not take the simple approach and try to trade one with the other. I see people trying to use this method on weeks or months when the EUR and the GBP are totally moving the opposite direction and they blow up their accounts in the process.

Learn how and why a currency moves and trade them independently.

4xtradingcoach

I don’t think Jennifer was saying to trade the EUR when you get a signal on the GBP. She stated that this is not a trading method.

It’s good to learn which currencies correlate with one another, and in what ways. That way you can avoid possibly overleveraging if you happen to take more than one trade at a time. In this way, knowing the relationship of correlating currencies can save you a lot of headaches.

It’s just another possible indicator to consider when getting ready to take a trade. Take it or leave it, but it’s not a trading method. At least not in the way Jennifer has described it here.

Yes,If we use our mind,Relating pairs do affect each other. It is a good strategy to keep an eye on such pairs.

I agree. I don’t use correlating pairs in my current strategies, but I have before. I found the technique to be pretty useful. If nothing else, they can help you stay out of a bad trade that you would have otherwise taken.