Japanese candlestick charting techniques just work, which is why they are so popular with traders in every market.

Nothing works all the time in every market condition, but candlestick charting techniques, when used correctly, can be just as profitable as any other strategy that I’ve tried.

Best of all, you can learn how to trade candlesticks for free online from resources like my price action trading course and others.

Of course, I haven’t tried every candlestick technique out there, and not everyone trades candlesticks the same way I do, but I’ve had success with many different candlestick trading techniques.

In this article, I’m going to show you some of my favorite candlestick trading techniques and why you should give them a try.

Profitable Japanese Candlestick Charting Techniques

The Japanese candlestick charting techniques below are in no particular order. I’ve used all of these techniques at one point or another.

No two traders are going to have the same amount of success with the same trading technique. I suggest finding a technique that makes sense to you and start testing it.

Keep in mind that you can combine many of these techniques if you’re looking for a more conservative approach. However, every filter that you apply to trading lowers the amount of trades you take.

At some point, filters become counterproductive. The goal, or at least what has worked for me, is to keep trading as simple as you can keep it while remaining profitable.

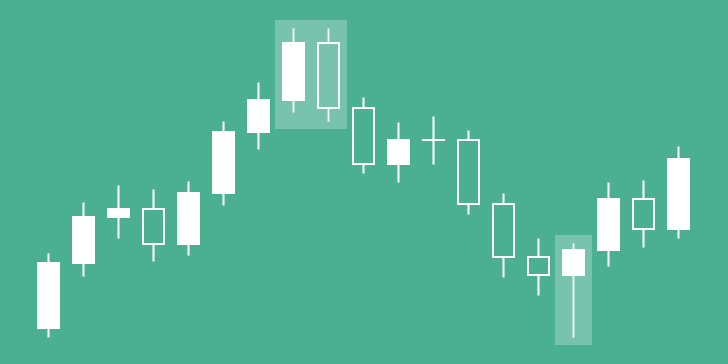

Naked Candlestick Trading

I first started my trading career with naked candlestick trading. I’ve taken courses from Nial Fuller and Walter Peters. I understand the appeal of pure price action trading, but I haven’t had much success with it myself.

Although I know of traders that make consistent profits with naked Japanese candlestick charting techniques and other naked price action techniques, I don’t personally recommend it.

The image above shows one of the reasons I’ve had problems with naked candlestick trading in the past. All of the highlighted patterns are legitimate naked candlestick trading setups.

Combining this chart with a simple stochastic or RSI indicator could have helped to eliminate most of these unsuccessful trades. Obviously, the extra filter would have likely eliminated some of the successful trades as well.

As it is, this particular section of the chart shows 5 winning trades and only 3 losers.

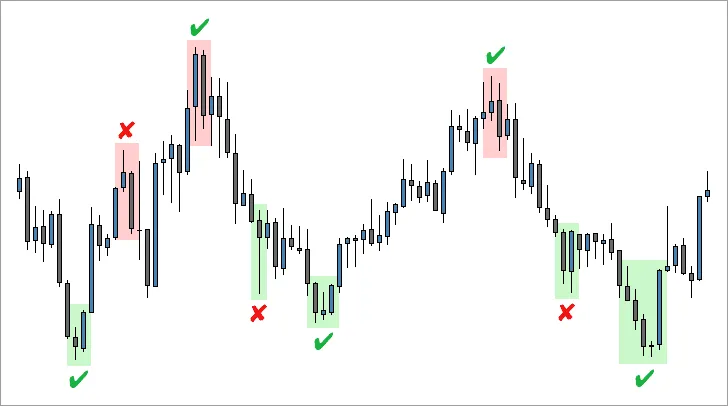

Support and Resistance Trading

Trading support and resistance is one of the most powerful Japanese candlestick charting techniques you can use. This technique also works well in combination with many of the other techniques on this list.

Of course, your success with trading support and resistance depends on your ability to choose significant levels.

Choosing support and resistance levels is one of the most subjective aspects of trading. It’s more of an art than a science. However, there are certain mechanical rules you can apply to help you choose good levels.

Bonus: Download my free eBook, How to Choose Better Support and Resistance Levels, to learn how to choose the most significant support and resistance levels to trade from.

In the image above, you can see a good support level. Price made a good move into the level and a healthy bounce away from it.

When price came back into that level, a bearish candlestick pierced into the level, testing it. Then a bullish candlestick closed back above it, forming a good bullish engulfing pattern.

In my experience, you will have much more success taking candlestick patterns like this than with naked candlestick trading.

Note: Before I get tons of comments on this, I realize that many naked candlestick traders consider support and resistance part of the naked candlestick trading technique.

Using support and resistance can improve the results of almost any trading strategy, but it takes skill to pick good levels and patience to wait for patterns to form at those levels.

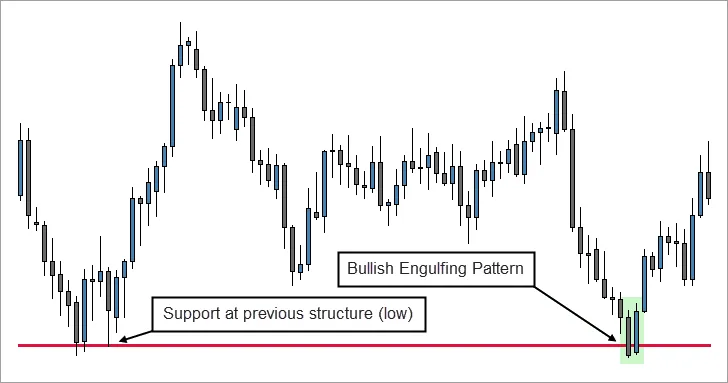

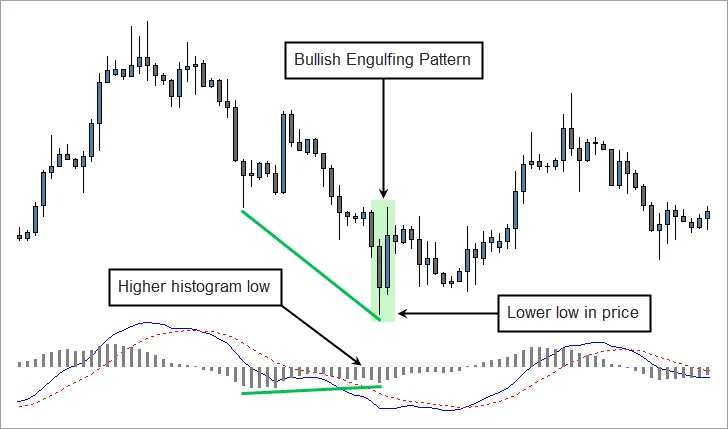

Candlestick Signals and Divergence

Of all of the Japanese candlestick charting techniques that I know, trading candlestick patterns in combination with MACD divergence has to be my favorite. I certainly use this technique more than any other.

The trick with this technique is to only take divergence entries after a decent downtrend or uptrend – one that has a good chance of being exhausted.

In the image above, you can see a healthy downtrend. While price was making lower lows, the MACD histogram made higher lows.

This could be a sign that momentum is leaving the downtrend. At the same time, a nice bullish engulfing pattern appeared, further building the case that a reversal was about to happen.

Note: To learn more about trading MACD divergence correctly, check out my article on how to trade MACD divergence.

Hidden divergence works the opposite way. In a downtrend, hidden divergence is measured off of the highs and is a trend continuation signal – not a reversal signal.

In my experience, you do not need to wait for a healthy trend to take a hidden divergence trade, although the setups that occur within strong trends usually will naturally have a higher strike rate.

In the image above, you can see another healthy downtrend. This time, as price is making lower highs, the MACD line and histogram are making higher highs.

This could be a sign that momentum is coming into the trend. Adding to the case of a trend continuation, you can see a couple of good bearish engulfing patterns that occurred after nice retracements.

These two candlestick patterns would’ve made great entry triggers.

Note: For a more in-depth explanation of the difference between regular divergence and hidden divergence, check out my article on how to trade hidden divergence.

Sometimes, trend retracements move more sideways than up or down, so it takes a little bit of experience to get a good feel for choosing quality candlestick patterns within these retracements.

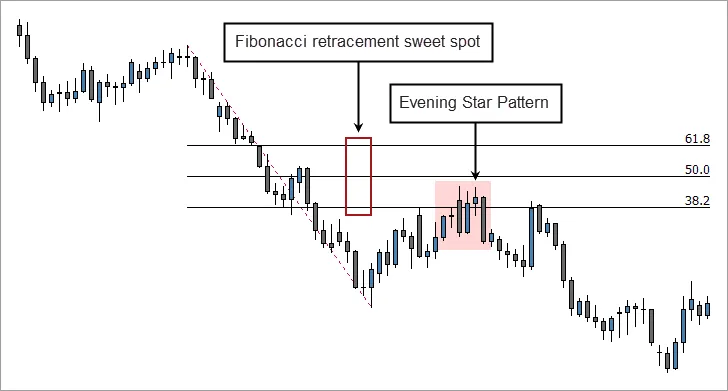

Fibonacci Retracement Trading

One of the most often used Japanese candlestick charting techniques is to combine candlestick patterns with Fibonacci retracements. You may have already seen my article about Fibonacci retracement trading.

The key to this technique is to only draw your Fibonacci tool off of healthy swings in price (see the picture below) and only take patterns that develop within the “sweet spot” of the Fibonacci retracement.

In the image above, you can see a nice swing low in price which the Fibonacci retracement was drawn off of. After price retraced into the “sweet spot,” a nice evening star pattern formed, engulfing 5 candlesticks.

Bonus: Download my free PDF report, A Profitable Fibonacci Retracement Trading Strategy, to learn a profitable Fibonacci retracement trading strategy.

One advantage to this technique, similar to trading hidden divergence, is that you are taking trades in the direction of the overall trend – as opposed to betting against the trend with a reversal trade.

However, like trading hidden divergence, it takes practice to choose quality candlestick patterns that form within the retracement of a trend.

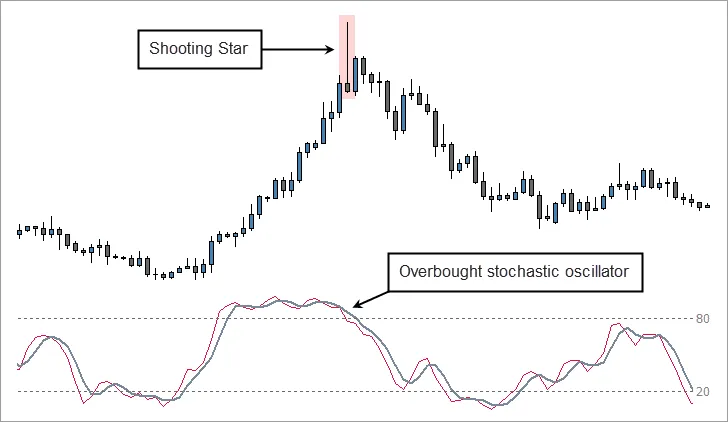

Candlestick Signals and Oscillators

Aside from using oscillators for trading divergence, you can also use some of them (like the stochastic oscillator pictured below) to simply judge whether or not the current price is “overbought” or “oversold.”

This is a very simple Japanese candlestick charting technique, but it can be effective in qualifying good candlestick patterns. In fact, this was the first technique that I combined with candlestick trading that actually worked for me.

The idea is that, if price is overbought, a bearish reversal is more likely to happen. If price is oversold, a bullish reversal is more likely to happen.

In the image above, you can see a strong bullish swing in price. At the top, a nice shooting star candlestick formed. Adding to the quality of the trade, price was overbought (above the 80 level) when the shooting star formed, according to the stochastic oscillator.

Note: In the image above, I’m using 8,3,3 settings. The default MT4 settings for the stochastic oscillator are 5,3,3.

When trading divergence, 8,3,3 or 5,3,3 typically works well. For determining when price is overbought or oversold, 14,3,3 or 8,3,3 typically works well.

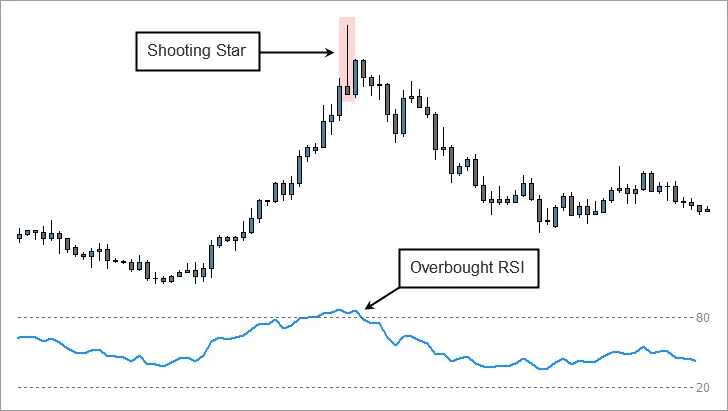

Many traders use the stochastic oscillator to determine when price is overbought or oversold. However, the RSI is also very useful for this purpose, if not more useful.

In the image above, you’ll see the same chart as earlier – this time with the RSI attached. As before, the shooting star formed as price was overbought (the RSI was above the 80 level).

Note: In the image above, I’m using the 80 and 20 levels instead of the default 70 and 30 levels. The 80 and 20 levels represent extremes in price.

Using the 80 and 20 levels, you’ll get less trades, but the trades that you take will be higher quality because price is more likely to reverse at extremes.

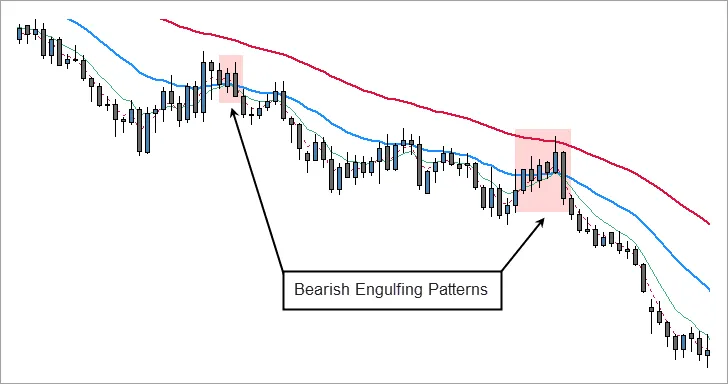

Candlestick Trading Within Other Systems

Another one of my favorite Japanese candlestick charting techniques, and one of the most profitable of all of the techniques that I’ve tried, is using candlestick patterns within other trading systems.

Keep in mind, not every trading system will work in combination with candlestick patterns.

For instance, at Day Trading Forex Live we use a very specific price action entry, called the “confirmation entry.” Candlestick patterns will not work within this system, at least not as entry triggers.

Strategies that take entries after pullbacks into trending moving averages (see the example above), when combined with good candlestick signals, can give you a real edge in any market.

Final Thoughts

Using these Japanese candlestick charting techniques will help you qualify better candlestick setups to trade. Of course, you’ll occasionally filter out a trade that would’ve been profitable.

The point is not to catch every profitable trade. The point is to increase your odds of taking profitable trades by focusing on quality over quantity.

As I mentioned earlier, you can combine many of the techniques listed. However, each new filter means fewer trades. If you combine too many techniques, you’ll never get a trade setup at all.

Traders that have been reading this blog for a while know that I’m a big fan of candlestick trading. However, I never trade pure naked price action.

I just haven’t had success with it, so I can’t personally recommend it. Your experience could be completely different. Do whatever works for you.

If you’re a new trader, I recommend trying a technique that works with the overall trend, like trading Fibonacci retracements or hidden divergence.

I hope that sharing this list of Japanese candlestick charting techniques has inspired you to try some of them or has given you some other ideas to try. Do you use any of these techniques or others in combination with candlestick patterns? Leave your comments and questions below.

I try to trade 1 hour or 30 minute Chart for the sake of small stop loss but not expert,

it is not successful trading on and off.

Thanking you for listening.

Thanks for the comment, Shaikh. You should always adjust your position size so that the amount you have at risk is the same regardless of how many pips are at risk.

Just Google “position size calculator” or use the one I use. Maybe sometime this year I can add a position size calculator to this site.

As far as not being successful, just keep practicing. Candlestick trading works, especially in the Forex market. Most of the techniques above will help you to qualify great setups and filter out many of the bad ones. Good luck!

Can I please use some of your clip art in my book

Thank you for this. Now I understand exactly what divergences mean.

Thanks for the comment, Sara. I’m glad you found this useful.

Thanks chris this atticle is so informative .im also a candle stick trader but this aticle has gave me more confidence .keep goodwork

Thanks for the kind words, Lawrence. Be sure to check out my free price action course, if you haven’t already. Good luck!

Hello

I use Japanese Candlestick like Engulfing pattern with trendline, is not so bad.

Thanks for the comment, Max. In my experience, trendlines hold up better in the equities markets than in Forex. Either way, it’s a good technique.

Hi chris,

i am wondering which timeframe do you use to trade candlesticks? I am trying to trade with 15 or 30minutes candlesticks with RSI . What are your opinions and personal preferences for this?

Hi Zack,

I use timeframes ranging from 15 minutes to the Daily chart. I’ve personally traded the 15-minute chart much more than the 30-minute chart. There are advantages and disadvantages to each.

For instance: You will get more trading opportunities on the 15-minute chart, but the 30-minute chart will provide you with slightly more meaningful signals.

do you relate the previous days 30 min/15 min charts with the current day chart while trading?

All previous price action is relevant in one way or another.

The technique I tried and tested successfully is the technique of highest open interest (call/put) and find it very informative and above all conveys a very clear messege that what the market is thinking currently? Is the market agree with the candle signal? Where the perticular index/stock heading? Obviously it works only in premium stock/index as there has to be enough liquidity in derivative segment of that stock/index.

Sounds like you’ve found a strategy that works for you. Good luck!

thanks Chris but limitation of this strategy as I mentioned is liquidity in F&O so if I have to buy a high beta stock (generally small and mid cap), I have to rely on the techniques of oscillators divergence which you have given. One more very reliable oscillator is a CCI oscillator which I use beside MACD, Stoch and RSI (the ever popular). Tell us in detail about CCI and its use? I also use 3 line break chart as told by Steve to minimize the noise in the chart and it sometimes give me better exit. Also my mastro is same as yours ‘Steve Nison’.

I haven’t used the CCI oscillator too much. Maybe I’ll write up a tutorial on it in the future. Steve is the way to go, brother. I trade candlesticks a little differently than he does now, but my base techniques and definitions are still based on what I learned from him.

is it possible for a beginner to trade without lose.

No… not really. Not a complete beginner. It takes knowledge to make money with it, just like anything else. That’s what this site is here for.

That doesn’t mean you have to lose money. Don’t do anything other than demo trading until you’re making consistent profits with it. Then, open a real account and start trading the smallest amount per trade that your broker will allow.

If you’re still making consistent profits, up your risk per trade slowly until you reach a point in which you are uncomfortable risking more. Don’t go crazy with it. 1% – 2% per trade is plenty for most traders – even if you have a small account.

You need to start with a trading system that works. I have recommendations for trading systems that work well for me as well as a plenty of free techniques throughout this site.

Thank you for the excellent tips on entry and exit….it has transformed my trading. I use it with 50 dma as the market plays there.

Great, Jp! I’m glad I could help.

Hey complete beginner here I wanted to ask whats the best way to get started with studying forex?Like where do you begin?I ask because forex is such a massive thing I have no idea where to start.I’ve been studying for the last 2 months but it feels like I’m getting nowhere.

Honestly, Leon, you need to invest in a good trading system. That way you’ll have a set of rules for what qualifies as a good setup and what you should ignore. A good trading course will also teach you how to handle other things that are important to trading, like psychology and money management. Otherwise, it’s really a shot in the dark.

There’s so much information available online, it’s hard to decipher what works, what techniques work together, and what you should completely ignore (believe me… there’s a lot of that). If you want to skip some headaches, just learn a trading system from someone who’s already figured that stuff out. I recommend DTFL because I know it works. That’s what I’ve been using for the last 6 years.

There’s no need to reinvent the wheel – especially when starting out. Can you piece together a Frankenstein system from the free information you can find online? Sure… you can. That’s not the way I did it. It will take longer and be a lot harder for you to become successful if you try to do it on your own.

You’re going to pay for your education one way or another. My thought is that spending a few hundred dollars on a trading course is much less costly than what you could potentially lose if you don’t know what you’re doing.

So if I use Xstation..can you give me RSI and STOCHASTIC OSCILLATOR?

I’m not familiar with that platform. Most trading platforms have the ability to add an RSI and stochastic oscillator.

Hello Chris,

i have question here, When MACD is making HH why still the price is falling. i thought it is positive divergence. Can you explain as how to identify the MACD positive and negative divergence?

I think you mean regular divergence and hidden divergence. In regular divergence, the idea is that momentum is leaving the trend and the MACD, for instance, is an advanced warning, e.g., the MACD is making lower highs while price is still making higher highs.

In the case that you mentioned, the MACD would be indicating that more momentum is coming into a trend that is already going because you’re talking about the highs in a downtrend.

To put it in terms of entry setups, you would use regular divergence for reversal trades and hidden divergence for trend trades.

It can be confusing at first until it clicks. I wrote a whole article about it here: https://www.fxdayjob.com/hidden-divergence-vs-regular-divergence

Hello Chris,

For example, when I take an entry only by a bullish engulfing after an downtrending and not combined with another indicator for my trade, whether this way of trading can be seen as ‘naked candlestick trading’?

Yes, I would consider that naked candlestick trading because you’re not using another indicator or any other metric to inform your trading decision.

Can I please use some of your clip art in my book

No. Sorry, Lisa. Good luck with your book.