I’m updating this guide because the bearish engulfing candlestick pattern has become, by far, my favorite price action signal over the years. I’ve learned a lot about trading it since I first published this back in 2012, and I wanted to update it to reflect my most current information and experience.

I first started trading price action patterns in 2011, and like a lot of price action traders, I immediately gravitated toward the pinbars (hammer and shooting star). In recent years, I’ve actually found the engulfing patterns to be much more useful for a few reasons.

First, contrary to popular belief, good engulfing patterns are stronger – second only to engulfing evening star and morning star patterns. Keep in mind that I said, “good engulfing patterns are stronger.”

I’ll go over what makes a good engulfing pattern later.

Second, good engulfing patterns occur much more often than good pinbars. This is more important than you might think, especially if you combine price action with other techniques like I do.

This only matters if the setups are good, but all things being equal, more is better.

Third, one of the proprietary techniques that I use to confirm a good price action pattern (which I will discuss below) is met by the engulfing pattern itself. Whereas other strong candlestick patterns don’t necessarily meet this rule on their own.

So why do I prefer the bearish engulfing candlestick pattern? This is a personal preference. I typically have more success with sell trades, so I always prefer the bearish version of any price action pattern.

Note: I know this because I keep a trading journal which allows me to analyze my trades at the end of every month. If you’re serious about your trading, you should do this too.

In this guide, I’m going to show you how to correctly identify and trade the bearish engulfing candlestick pattern. Some of the techniques that I will discuss below are well known. Others I’m sure you will not have seen anywhere else.

Most of the examples are based on the Forex market, but these techniques work just as well in other markets.

Just in case you’re completely new to this pattern, we’ll start with the basics.

What is a Bearish Engulfing Candlestick Pattern?

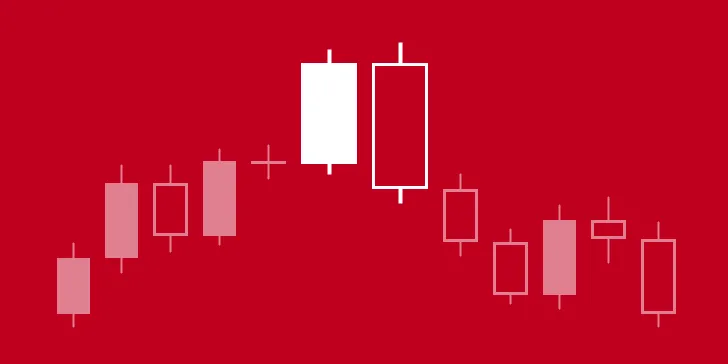

A standard bearish engulfing candlestick pattern is simply a candlestick that opens at or above the close of the previous candle (almost guaranteed in Forex) and then closes below the open of the same (previous) candle.

Notice we’re talking about the real bodies here (see the image below).

Note: Some traders consider a bearish engulfing pattern to be one in which the total range (high to low) of the bearish candle also engulfs the total range of the previous, bullish candle. Others don’t consider the real bodies at all.

I haven’t found this to be useful in my own trading. For the purpose of this guide, we will be discussing the price action of the real bodies (open to close) of the candlesticks involved in creating this pattern – not the total range of the candles.

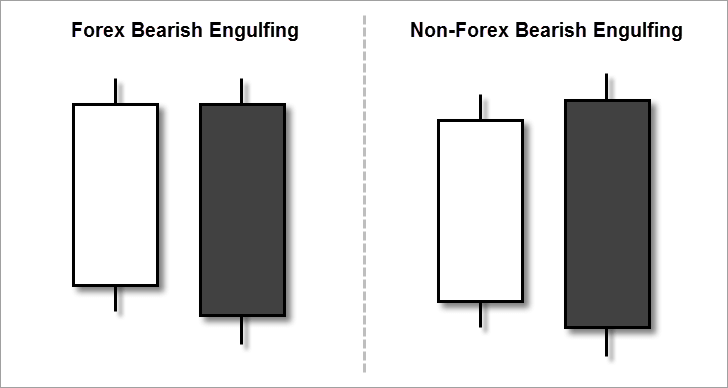

If you’re trading this candlestick pattern in any other market than Forex, you will likely be dealing with gaps from candle to candle. In such cases, the engulfing candlestick should gap up and then close below as seen in the picture above (under Non-Forex Bearish Engulfing).

Note: Gaps occassionally occur in the Forex market as well. Sometimes a small gap up is followed by a bearish engulfing candlestick.

As long as all of the other requirements are met, such patterns should be considered valid bearish engulfing signals. In fact, these rare patterns can be particularly strong due to the added closing gap technical pattern.

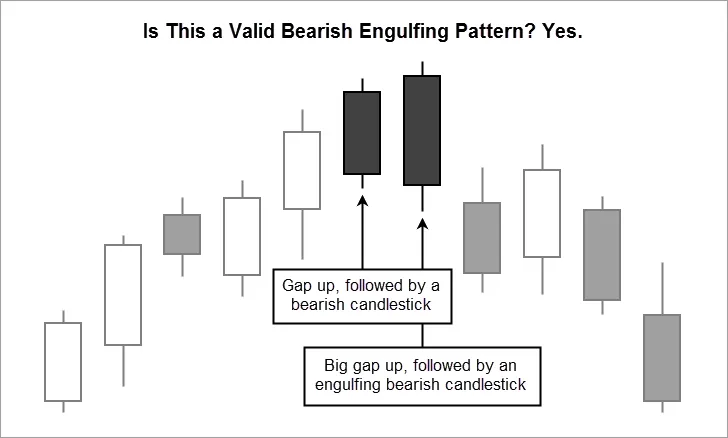

Also, depending on how much gapping occurs in the market (non-Forex) that you’re trading, it’s possible to see a valid bearish engulfing pattern that consists of two bearish candlesticks – in which the second bearish candlestick has gapped up and engulfed the first (see the image below).

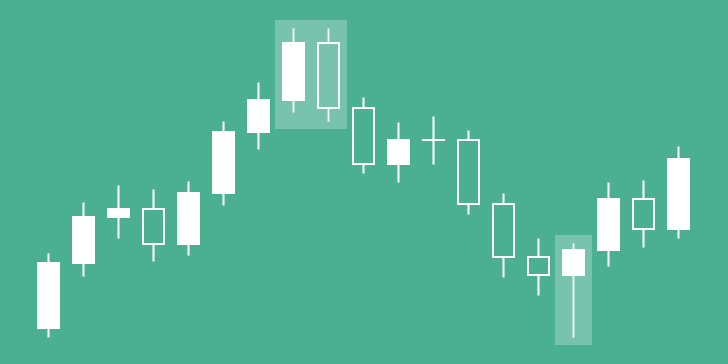

Lastly, this pattern is considered to be a strong bearish reversal signal. As such, a true bearish engulfing pattern will only come after a bullish movement in price (consecutive higher highs). Never trade this pattern in a period of market consolidation (flat/sideways price action).

What Makes a Good Bearish Engulfing Pattern?

Over the years that I’ve been trading this pattern, I’ve picked up or developed a few filters that help to qualify good bearish engulfing patterns. Like many of the techniques I’m discussing in this guide, these filters can be applied to other price action patterns as well.

These filters have drastically increased my strike rate with these patterns, but the tradeoff is that you will get fewer qualified trades (quality over quantity).

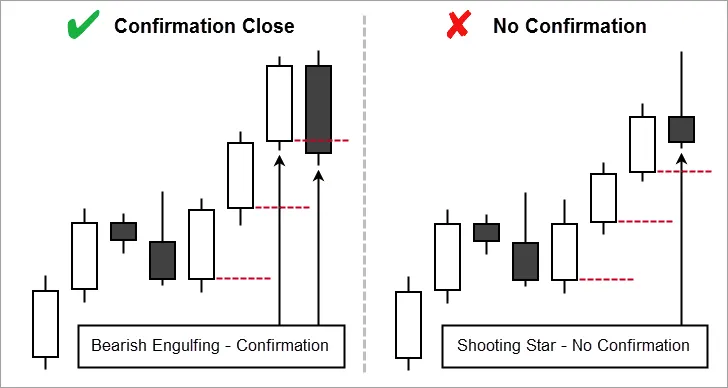

Confirmation Close

The first filter is the confirmation close. Earlier, I mentioned that one of my proprietary filters is necessarily built-in to the bearish engulfing pattern. This is what I was referring to.

The confirmation close is simply one additional clue that the trend is likely to reverse. It occurs, in the case of a bearish engulfing pattern, when the second candlestick in the pattern closes below the real body of the first candlestick (see the image above).

Note: This works because the first lower real body in an uptrend is often a signal of an upcoming retracement or reversal – regardless of whether or not a price action pattern is involved.

As you can see, the engulfing pattern has it’s own confirmation candle built right in. In the case of the shooting star, I would still be waiting for a confirmation down because it did not close below the real body of the previous candle.

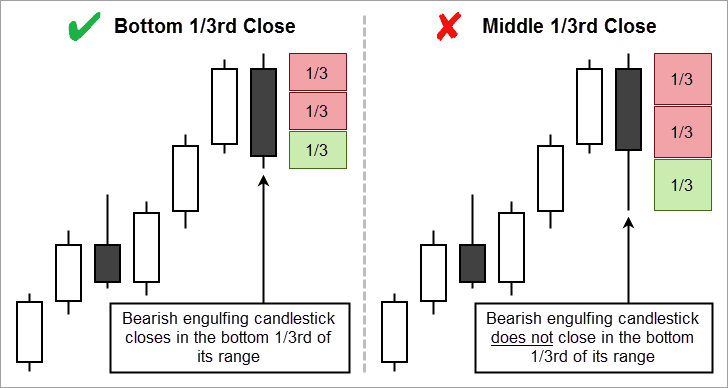

Close Relative to Range

The next thing you should consider when trading the bearish engulfing candlestick pattern is whether or not the engulfing candlestick closes within the bottom 1/3rd of its range (see the image below).

The idea behind this filter is that a long lower wick (sometimes called a shadow) is a technical indicator that can represent a bullish rejection of price.

The fact that price has already recently been lower but bounced back up, which could mean that the market is rejecting prices below the close of the pattern, lowers the odds that bearish strength will follow through driving prices down.

Also, in general, bearish candlesticks that close near the bottom of their range are considered to be more bearish. The closer the close is to the bottom of the range the better.

Note: When using this filter with other candlestick patterns, remember that it should apply to the signal candlestick (or the final candlestick in a multi-candlestick pattern) as well as the confirmation candlestick.

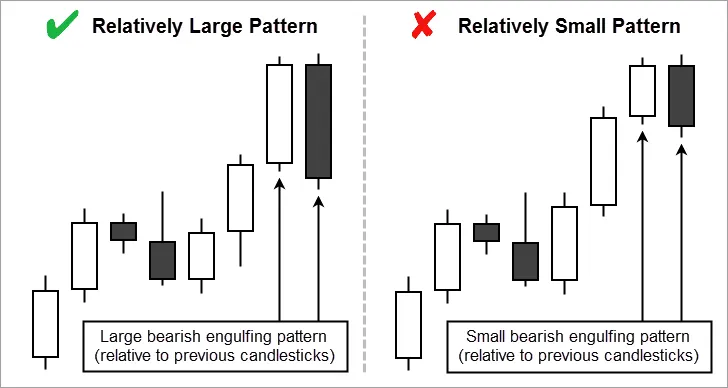

Relative Size of Pattern

The size of the bearish engulfing pattern, relative to the size of the candlesticks that came before it, is also significant. If you’ve been trading price action for a while, you’ve probably heard about this filter before.

Basically, larger candlesticks are more significant, so price action patterns composed of larger candlesticks are more significant.

Also, the further back you have to count to find other candlesticks of similar size, the more significant the candlestick is. For instance, if your bearish engulfing pattern is larger than the last twenty candlesticks that came before it, that pattern is more likely to be significant.

Note: You can still trade bearish engulfing patterns that are slightly smaller than previous candlesticks. However, if you assign scores to your trades in your trading journal, you may want to take a point away for the lower strength of the pattern.

You basically want to avoid taking price action patterns that are significantly smaller than previous candlesticks. In such cases, the market is telling you that the pattern is not important.

The relative size filter applies to both candlesticks in the bearish engulfing pattern as well. In my experience, when these patterns are formed by engulfing a single candlestick which has a small real body, they are not significant enough to trade.

Trading the Bearish Engulfing Candlestick Pattern

Assuming your bearish engulfing candlestick pattern has passed all of the filters above, it’s time to actually place and manage your trade. Of course, you’ll want to backtest and demo trade these techniques before trying them in your live account.

Entry

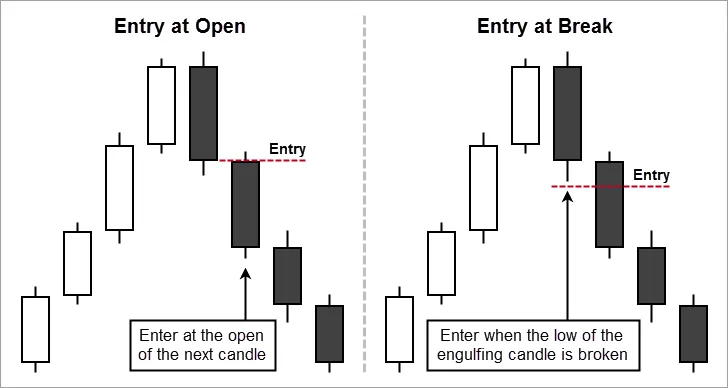

The first thing I want to go over is where you should actually place your entry when trading the bearish engulfing candlestick pattern. There are several techniques that you could use, but I only recommend using the two standard entries and my 50% entry.

Most of the time, you will want to use one of the standard entries. The 50% entry is used only in certain situations which I will explain in detail below.

Standard Entries

The first standard entry technique for the bearish engulfing candlestick pattern is to simply place a sell order at the open of the next candlestick (see the image below – left). Of the two standard entries, this is my preferred method to use because it creates a more favorable reward to risk scenario.

If you use the MetaTrader 4 platform, you can use this handy candlestick timer to help you time your entries with this first method.

The next standard entry method is to wait for a break of the low of the engulfing candlestick. In the Forex market, your entry would be 1 pip below the low (see the image above – right).

Note: Depending on the size of the wick, entering at the break of the low of the engulfing candle could lead to poor risk to reward.

Whenever possible, you should use a sell stop order to enter the market while using the second standard entry. This ensures that you will get an accurate entry, and it keeps you from being forced to stare at your screen, waiting for a break of the low.

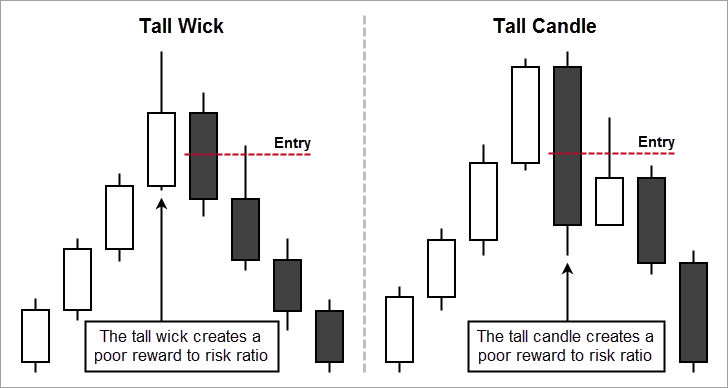

The 50% Entry

This next entry should only be used when the standard entries are likely to result in a poor reward to risk scenario (which I will go over in more detail later on).

A tall upper wick or a tall engulfing candlestick means you would have a larger than usual risk (in pips or points).

A larger risk means you are less likely to hit your profit target because some of the reversal that you were hoping for has already been taken up by the tall wick or candle. It also means that your reward must be larger (in pips or points), which further decreases the odds of hitting your target.

Basically, both cases create a poor reward to risk scenario.

The solution is to seek a price improvement. I do this with the bearish engulfing candlestick pattern by waiting for the price to pull back to 50% of the total range of the engulfing candlestick (see the image above).

If I do get a pullback, I end up with a much better entry, and the odds of hitting my full take profit go way up.

Note: Occasionally, when using this method, you will miss some trades because the price will not always pull back to your entry.

I’m okay with that because I only want to take high quality trades that provide a real edge in the market (quality over quantity).

Whenever possible, you should use a sell limit order to execute the 50% entry. Again, this will help you get an accurate entry, and keep you from being forced to stare at your screen waiting for a pullback.

Stop Loss

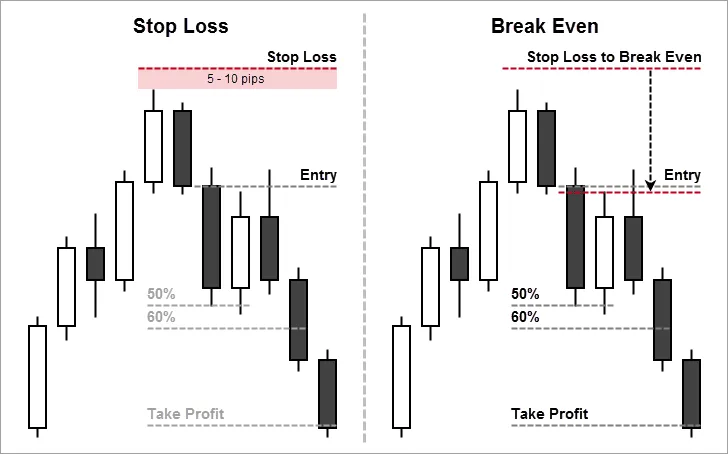

Next, we need to talk about where to place your stop loss while trading the bearish engulfing candlestick pattern, moving your stop loss to a breakeven point (optional), and when you should do that.

You always want to place your stop loss at the nearest area where you know you’re wrong about the pattern if the price reaches it. In a bearish pattern, you know you’re wrong if price makes a new high.

In the Forex market, you pay the spread when exiting a sell trade, so you should add the spread to your stop loss. If you don’t, you could be stopped out of your trade before price actually breaks the high.

A good rule of thumb is to place your stop loss 5 pips above the high of your pattern (see the image below). This allows enough room for your average spread plus a few pips above the high in case the spread spikes slightly.

Note: On the Daily chart, you should place your stop 5 – 10 pips above the high. Basically, if you can see a gap between the high and your stop loss, that should be about 5 – 10 pips, which makes trading on the Daily chart a bit easier.

After price has moved down in your favor a bit, you can move your stop loss to break even on the trade, just in case it doesn’t follow through all the way to your take profit. This technique is optional, although I personally use it and recommend it.

I personally move my stop losses to breakeven plus 2 – 3 pips (depending on the pair) to cover the spread after price reaches 60% of my intended profit target.

In other words, if my profit target is 100 pips, I move my stop loss to breakeven plus 2 – 3 pips after the trade has gone 60 pips in my favor.

Why 60% and not 50% (or 1:1 reward to risk)? Often price retraces back to the entry or further once the 50% (or 1:1) target has been reached (see the image above).

Note: The market makers do this to increase their positions before continuing the move down because they know many traders move their stops to breakeven at 1:1.

This is a technique that I picked up from Sterling at Day Trading Forex Live that has worked very well for me.

If you use the MetaTrader 4 platform, you can use this break even EA to automatically move your stop loss for you. That way you don’t have to sit in front of your computer screen waiting.

Take Profit

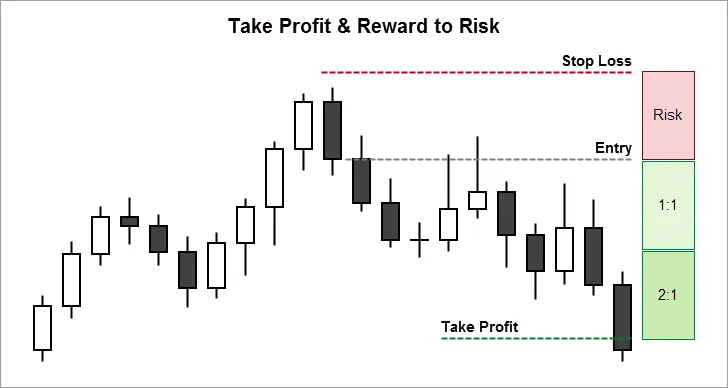

When trading price action patterns, I occasionally shoot for different profit targets, based on what kind of pattern I’m trading and the reward to risk scenario it provides. For instance, I usually target a 3:1 reward to risk ratio when trading the harami patterns.

However, when trading most other price action patterns, including the bearish engulfing candlestick pattern, I target a 2:1 reward to risk ratio.

What this means is that, if I’m risking 50 pips, I place my take profit 100 pips away from my entry (see the image above). Over the years, this has worked out very well for me, especially with the bearish engulfing pattern.

Note: Some trading systems don’t use set take profit levels. Instead, they use a trailing stop in one form or another in an effort to catch as much of the trend or reversal as possible.

In my experience, I can target a 2:1 reward to risk ratio with the bearish engulfing pattern and achieve a high enough strike rate (by combining it with a good trading system or the additional techniques below) to achieve consistent profits over time.

Bonus: Combining Techniques

Those of you who have read any of the other posts in my free price action course, probably already know that I don’t trade price action alone. I’ve experienced much better and more consistent profits by combining price action patterns with other, complimentary trading strategies.

If you can’t use these price action patterns as entry triggers in an already profitable trading system, combining them with the techniques below is the next best thing.

Resistance Levels

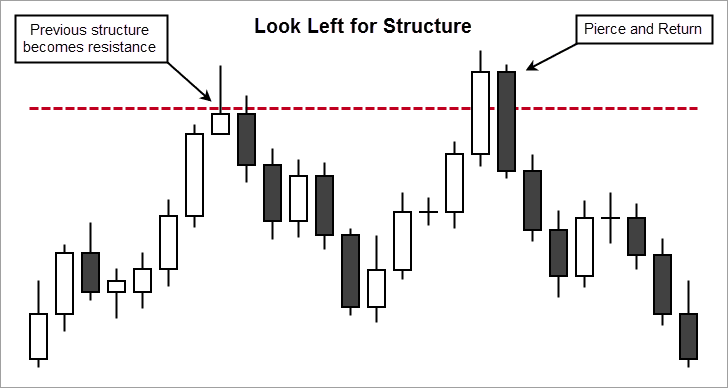

You’ve probably heard before that combining price action with support and resistance can be very profitable. This is true, as long as you are choosing good levels to trade from.

When trading the bearish engulfing candlestick pattern, the idea is to look to the left of the chart for any previous structure that may act as resistance.

In order for a resistance level to be considered good, there should be a nice surge up into the level, as well as a nice bounce down away from the level. There also shouldn’t be any other competing higher highs in recent history.

It helps to remember that support and resistance act more like zones than exact price levels. That being said, you should always draw support and resistance levels off of the real bodies of the candles – not the wicks (see the image above).

Once you’ve established a good resistance level, keep an eye out for bearish price action signals, like the bearish engulfing candlestick pattern, forming at or near the level.

I like to see at least a wick, from the candlesticks involved in the pattern, that touches the resistance level. The best setups, however, occur when the bearish engulfing pattern pierces the level and then returns because this is often a sign that the market makers are performing a stop run to set up a reversal (see the image above).

Note: For an in-depth guide on how to choose the best support and resistance levels, download my free eBook, How to Choose Better Support and Resistance Levels.

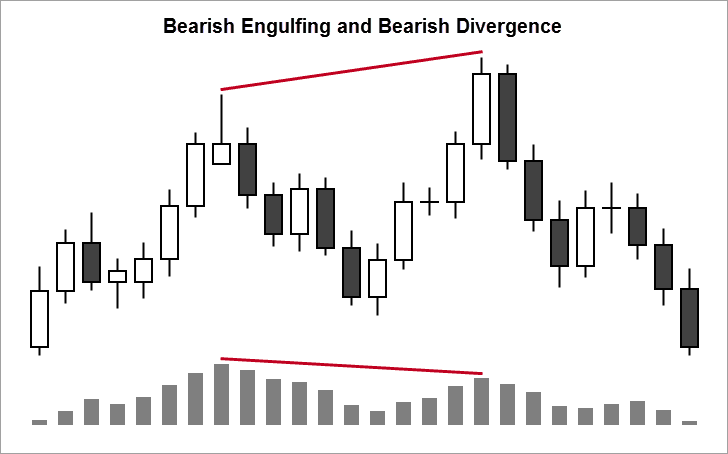

Bearish Divergence

I love trading divergence. The first trading system that worked for me used stochastic mini-divergence for setups, and I still seek out divergence patterns today. I especially love trading MACD divergence.

Bearish MACD divergence occurs during an uptrend when price is making higher highs while the MACD line or histogram (pictured below) is making lower highs.

The idea is that the lower highs on the MACD line or histogram could be an early indicator that momentum is leaving the uptrend, which increases the odds of a reversal. When combined with a strong bearish reversal signal, like the bearish engulfing candlestick pattern, the odds of a reversal are even better.

In divergence setups like this, divergence is actually the key signal. The bearish engulfing candlestick pattern, or another bearish candlestick pattern, is only used to laser target your entry.

Note: In order to properly trade MACD divergence you must make sure you’re using the correct MACD indicator. The default indicator in MetaTrader 4 and many other platforms will not work.

Divergence trading strategies other than MACD divergence will also work well with most price action patterns. In fact, as an extra filter, many divergence traders like to wait for divergence to occur on multiple indicators before entering a trade.

Final Thoughts

Context is everything. A true bearish engulfing candlestick pattern is a strong reversal signal, which means it should never be traded from a consolidating market (choppy, sideways, or tight ranging). It should only be trading after an uptrend.

As long as the pattern passes the filters above, especially if you’re combining it with other qualifying strategies, you should be profitable.

The bearish engulfing candlestick pattern is generally considered to be stronger if one or more of the candlesticks involved in the pattern have tall upper wicks (especially when this creates an engulfed shooting star). Although the signal may be stronger, this usually creates a poor reward to risk scenario. However, I showed you how to deal with that.

Occasionally, multiple candlesticks are engulfed in the pattern. In such cases, it’s considered to be stronger (more candles engulfed = more strength).

Note: I mentioned earlier that bearish engulfing patterns formed by engulfing a single small real body candlestick have not been strong enough to trade in my experience.

However, patterns in which multiple small real body candlesticks are engulfed are acceptable if not stronger than usual.

The bearish engulfing pattern is considered to be stronger if the engulfing candlestick is very large, especially if the candlestick that is engulfed is also large. Again this creates a poor reward to risk scenario, but you know how to deal with that now.

Finally, when a bearish engulfing candlestick’s total range also engulfs the previous candlestick’s total range, it’s considered to be stronger than when only the real body is engulfed.

This guide is a product of over 40 hours of work and 10 years of trading experience. Do you agree that this is the ultimate bearish engulfing candlestick guide? Did you find it useful? Do you think I left anything out? Please leave your questions or comments below.

You are gorgeous , Thank you a lot for very informative info

Thanks for the kind words, brother! I’m glad I could help you.

Thanks bro for sharing

No problem. Thanks for reading.

Hi Chris

Thank you very much for this useful content.

What do you mean by that exactly ?

Note: The market makers do this to increase their positions before continuing the move down because they know many traders move their stops to breakeven at 1:1.

The 1:1 reward-to-risk ratio is a common place for traders to move their stop losses to break even. The market makers know that so they sometimes move the market back up after retail traders have moved to break even, and they take out their stops. That allows them to strengthen their positions even more before they continue moving the market down.

It depends on what kind of trading you’re doing but my point (especially for candlestick trading) is that it’s not a good idea to move your stop loss to break even at 1:1. I hope that helps.

Hi Chris

Thank you 🙂

No problem. Glad I could help.

Hi Chris thanks alot I have one question, please how can this be applied in short price action

These techniques can be applied to any time frame. I just don’t personally go lower than 15-minute charts myself. Was that what you meant? If not, please elaborate.

Hi Chris, Thanks alot for ebook “How to choose good supports and resistances”, I have a question:

At Page 9, “The problem is that the bounce may just continue downward, starting a new downtrend, and leaving you without a second chance at it.”

What is the first chance?

What is the second chance?

Please explain more, Thank you.

Hello Vinawings,

I’m glad you’re enjoying my ebook. In that scenario, the trader is looking to initiate a trade at a level where price found significant resistance in the past. 14 is the same level that gave support at 1,3, and 5. Now there is a good chance it be a significant resistance level.

However, after price has not revisited that level in so long, it may be adjusted slightly higher or lower, which often happens. In that scenario, the first chance would be if you took a sell trade in anticipation of a bounce down at 14.

A more conservative approach would be to wait for another significant bounce at that level to see if it has been adjusted over time. It had been adjusted slightly higher over time as you can tell by the bounce at 15. The same is true for 13 and 16. The whole thing had shifted slightly higher over time.

The problem with the more conservative approach is that you won’t always get another opportunity to take that trade. It could have bounced at 15 and kept heading downward. In our example, however, it bounced back up at 16. It eventually returned to the adjusted level formed at 15, giving us a second chance at taking a sell trade from that level.

In the example, the second chance that I’m speaking of isn’t marked with a number, but it should be pretty obvious because it’s the only time during the period shown that price returned to the new level formed at 15.

I hope that helps and that I didn’t just confuse you further. Let me know if you still have any questions about it. Good luck!

Hi Chris,

Thanks alot for your responds,

I’ve got the good idea from your explaining!

The ebook is so perfect!

Thank you so much!

Great! I’m glad I could help. Good luck!

Hi Chris, I’m new to your site, glad i joined after reading this. Very concise. Actually my main strategy is almost any engulfing candles, as long as they are on a trend. Great % success rate.

I’m glad you liked the post. I’ve had a lot of success with engulfing patterns as entry triggers as well. With the right setup, they work really well as a trend trade entry.

Iam from india, very usefull ur engulfing method thank u so much

I’m glad you found this post useful, Kumar. Good luck!

Chris, This is an excellent article on Bearish Engulfing thanks for your time and knowledge to spare with us. I did study Candle Sticks for a while and used it not as a trader but at times for swing trades on part time basis. Just today EOD I entered into a new trade with Alibaba in US symbol BABA with a short position at 169.74. I was looking for material online to deepen my knowledge to support my decision, and your article really helped me.

Will keep posted as my trade progresses

Thanks for the kind words, Francis. I’m glad I could help you.

Great information about Baerish Engulfing.

I just miss one thing: What about 3 green candles before baerish Engulfing candle? Should’t this not also be seen as important filter!?

Hey, Frank. Thanks for the question. I understand that is a filter some candlestick traders use. In my experience, I have not found the amount of bullish candles to matter, whether it’s 3, 4, 5, etc. I only care that the engulfing pattern happens after a nice bullish push.

I mentioned this in the article, “. . . this pattern is considered to be a strong bearish reversal signal. As such, a true bearish engulfing pattern will only come after a bullish movement in price . . .”

Of course, use whatever filters work for your system. Hope that answers your question.